Overseas contractor jobs /Pay for international employees to show a rise in recent years. Let’s find out the trend of Make Mass Payments to international Suppliers, Vendors, and Employees Overseas at low costs & why it helps automate your Business Payments.

How US Companies Pay Foreign Employees

When a US company decides to expand overseas and hire foreign employees, it must first research and comply with the legal requirements for hiring employees in the new country.

To legally pay foreign employees overseas, companies can either set up and incorporate a legal entity or use a global Employer of Record (EoR) service. While both options enable companies to expand their workforce internationally, the former involves greater commitment and risk than the latter.

- Register a local legal entity in the country where the employee lives and works, and then hire the employee directly using that entity.

- Partner with a reputable, professional employer organization to hire employees on your behalf. Use employer of record (EOR) for hiring employees on behalf of your company.

Regardless of the payment method, the company must ensure that it complies with all tax laws and regulations in both the US and the foreign employee’s country. This includes reporting employee income and withholding taxes as required by local laws.

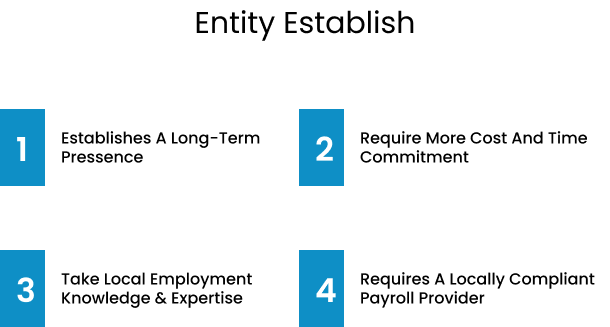

Establishing a Legal Entity Abroad

Before expanding their operations abroad, companies should consider the payroll challenges involved in setting up a legal entity in a foreign country.

A multi-country payroll solution simplifies paying international employees for US companies with country-compliant processes, automation, and integration with related tasks such as time and attendance management.

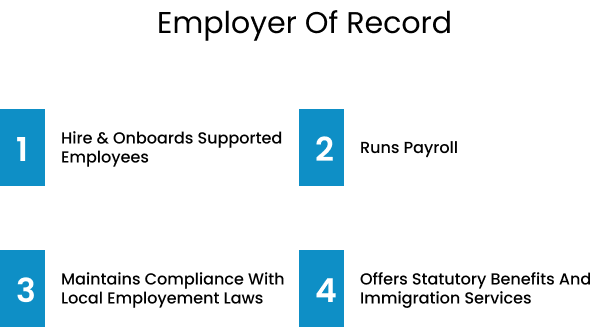

Partner With an Employer of Record

An EoR is a third-party service provider that acts as the employer of record for a company’s foreign employees, handling all payroll and compliance responsibilities on behalf of the company.

By partnering with an EoR, US companies can avoid the complexities of setting up a legal entity in a foreign country, as the EoR is already established and compliant with local laws and regulations. This allows companies to quickly and easily hire foreign employees without the need for a physical presence in the foreign country.

In addition, partnering with an EoR can provide companies with greater flexibility to scale their international workforce up or down as needed. The EoR can handle the administrative burden of hiring, managing, and paying employees, allowing companies to focus on their core business operations.

Overall, partnering with an EoR can be a cost-effective and efficient solution for US companies looking to expand their operations overseas while mitigating legal and compliance risks.

How to pay international employees’ contract

Based on the above 3 methods of hiring employees, depending on your financial situation, rental conditions, and development goals, you can choose the corresponding payment methods.

Through a locally established legal entity

Setting up a legal entity in the hiring country, you can pay international employees with the same legal entity established in the locality where they live and work.

There are three main types of local legal entities you can create: a representative office, a branch office, or a foreign subsidiary.

Representative offices are quick and simple to set up, but this model doesn’t allow you to hire individuals to take on revenue-generating roles like sales and management.

Branch offices are more flexible than representative offices, but setup costs can be expensive, taking longer to set up.

An overseas subsidiary can be cost-effective to set up but can be time-consuming to manage.

Through the service of a global PEO

Global PEO means a global professional employer organization and is a company that handles responsibilities such as recruitment, referral and payroll administration on behalf of another company.

Also known as the Global Employment Organization (GEO) and Employment on Record (EOR), the PEO will perform these duties while ensuring that your company complies with local laws and regulations. direction.

Your company can delegate payroll responsibility to a PEO of your choice, and it will take care of everything from paying employees’ base salaries, to paying for health insurance to handling tax deductions.

Paying international employees as contractors

You can pay some of your international employees as contractors instead of traditional employees. However, you must properly categorize your employees to stay compliant and avoid any legal trouble.

Labor laws will vary from country to country, so it’s best to research your contractor’s contract regulations.

Often contractors are paid by the hour or by project, and they usually take care of their own taxes and insurance. Contractors are also not entitled to any employment benefits such as sick leave and paid leave. Some organizations intentionally circumvent employees by hiring contractors, in order to save some stipends and paid benefits.

How to process payments for international employees

4 steps to pay employees working across international borders are:

- Choose the currency that pays international employees: It’s best to spend your workers in their local currency if possible. That way, they’ll be more accessible and won’t be subject to low exchange rates. For its part, monitor currency fluctuations and exchange rates for accurate salary and bonus calculations.

- Working hours and time zones: The countries in which your employees work may have limits on the number of hours worked daily, weekly, or monthly. You need to know to be able to calculate and enforce overtime benefits under local labor laws.

- Review and comply with labor laws: Countries have specialized agencies for labor management and tax administration. When you pay international employees, you should familiarize yourself with these agencies, and enlist their advice to avoid risks.

- Send the payment

What is Best way to pay international employees

Among the 3 payment models for legal entity establishment, payment through global PEO service and Paying international employees as contractors, according to the assessment of businesses and employment experts, choosing to pay through global PEO service has many advantages. useful. That is:

- Reduce payroll costs: Partnering with a global payroll company can save you a significant amount of money on recruitment costs. You don’t need to hire in-house staff to handle loads of paperwork, calculate payroll and taxes, manage benefits, provide legal advice, and process payments. With EOR handling all of your payrolls, your HR team can focus on other tasks.

- Ensure compliance with global payroll: Local labor laws can be elusive, and that only becomes more difficult as you take on employees in more countries. However, with a good EOR, you can take on employees in multiple countries with minimal complexity. Your global payroll partner will ensure that you meet all legal requirements and keep you up to date with changes in local laws.

- Stronger data security: The probability of payroll fraud increases when payroll is processed internally, as more people have access to the data. Outsourcing the process to a global payroll partner improves security by limiting the number of people who have access to your payroll data, keeping it from being compromised.

- Higher Employee Satisfaction: When you work with a dedicated payroll partner, you minimize the chance of payroll errors. Not only do they make sure wages are calculated correctly, but they also make sure all payments are on time. With reliable payroll, your international employees will have a great experience working with your company.

- Local wage standards and compensation structures: A global payroll partner should be able to conduct effective wage setting on your company’s behalf. That means giving a complete breakdown of compensation packages including wages and benefits available in specific sectors, countries, and companies.

As a result, in TVN opinion, the best and low-cost way is hiring a local service. Businesses can pay international employees by hiring EOR company (employees of record companies). To simplify the process of paying international employees, contact TVN today and learn more about our solutions.

Tiếng Việt

Tiếng Việt

Related posts: