Using independent contractor show an slowly increase in recent year due to cost problem. Therefore, Independent contractors bring employers the quality of time-consuming tasks, make the most of the available external resources, thereby helping the company grow stronger.

What is an independent contractor

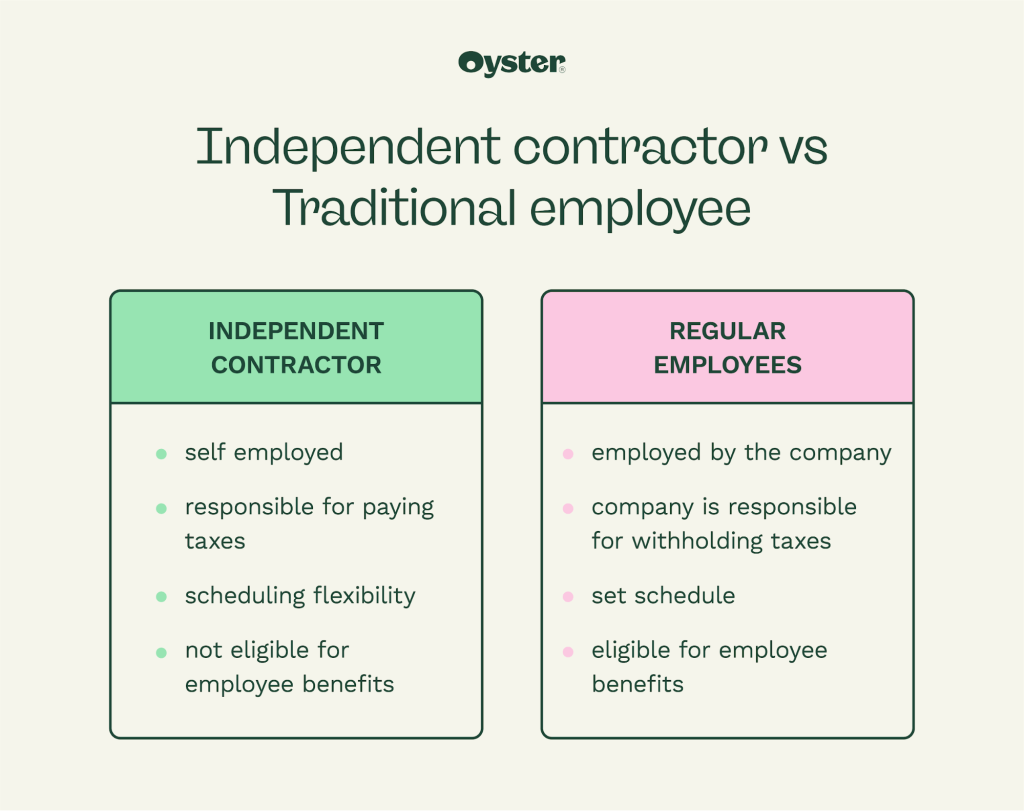

Independent contractor (IC) provides work for another person or organization under contract but not classified as employees. IC are not under the control and direction of a company or person to whom they are providing services.

How to hire independent contractors

- Write the job description and define the relationship

- Create an independent contractor agreement

- Hire an HR expert to follow the rest

How to pay independent contractors

It is depends on the facts in each case, which can paid according to the quantity and quality of products made. This is a form of wage payment that closely ties the labor function with labor remuneration. It has the effect of encouraging employees to improve labor productivity, contributing to increasing products.

The process is as follow:

- Request for Taxpayer Identification Number in Collect W-9 Forms

- Set Up Contractors in Your Payroll System

- Pay the freelancer according to the schedule and method agreed

- Notify the independent contractors

Too many steps? Chat with us to reduce the time & money!

How to file taxes as an independent contractor independent contractor vs employee

Individual tax returns to report income and expenses to the IRS. An independent contractor who structures their business as a corporation, a partnership or an LLC with more than one member may file a separate business tax return.

Once business has determined, the next step is to fill out the appropriate forms and pay the respective taxes.

How to become an independent contractor

The 4 steps that one must follow to become a independent contractor are explained below:

- Step 1: Get a degree related to the required field

- Step 2: Gain Position, Experience and Skills in required field

- Step 3: Get Contract License

- Step 4: Manage business contracts

How much taxes does an independent contractor pay

The required tax are listed as follow:

- Self-employment tax: 15.3% of your net business income

- Income tax: your total income for the year minus any deductions

What is a contract worker?

A contract employees currently under a work service contract under Labor Law (implementation of labor contracts), or the Civil Law (implementation of labor contracts).

According to the Viet Nam Labor Law, there are 03 types of contract employees:

- Employees under definite-term labor contracts: the two parties determine the term and time of termination of the labor contract in the period from full 12 months to 36 months

- Labor contract employees with indefinite term: the two parties do not specify the term, the time of termination of the labor contract

- Employee on a job-based labor contract or a certain job with a term of less than 12 months (3)

Usually in short words in life, a contract employee is understood in terms of (1) and (3), as a fixed-term contract employee.

Contract staff under the Civil Law

In order to carry out short-term projects, some companies will hire contract staff (civil service managers) according to the operating mode.

Usually this type of contract workers are freelancers (freelancers) who just need to draft a contract and assign the job to ensure they can get started right away – no down time required. long to meet input with the company.

The degree of organizational commitment to the company is also simple.

Contract employee benefits

*For contract employees complying with the Labor Law:

Employee benefits are implemented in accordance with the Labor Law.

Accordingly, a labor contract is an agreement between an employee and an employer on paid jobs, wages, working conditions, rights and obligations of each party in the labor relationship.

From 2021, employees when entering into a concluding labor contract are protected by law with the following rights issues:

- Maximum probation period: Probationary period does not exceed 180 days for business managers, max is 60 days for college degree or higher; 30 days for intermediate level; 6 days for different jobs. Employees are only allowed to try 1 job for 1 job and do not apply employment for contracts of less than 1 month.

- Probationary salary: The probationary salary is at least 85% of the official salary. After meeting the requirements, the employee and the employer must sign the labor contract immediately.

- Official salary: The official salary as agreed but must not be lower than the minimum wage

- Overtime pay: If the contract stipulates overtime, it is necessary to consider determining the overtime working time, overtime salary according to the current Labor Code.

- Regulations on Tet holidays: 1 year, employees have 10 days of public holidays, Tet and 12 days of leave

- Regulations on welfare: Salary increase, bonus, payment of health insurance, social insurance, maternity, survivorship…

- With contract staff complying with Civil Law (Service Contract)

Since you are not a full-time employee under an employment contract, the company cannot provide benefit packages.

In addition to the deposit amount specified in the cooperation service contract, you will not have any other amounts, for example, you will not be paid by the company for health, social, holiday insurance …

In order to ensure long-term benefits and welfare regimes, as well as increase cohesion with the organization, implementing regimes under labor contracts is necessary for all employees, especially young people, in age-age dynamic.

The regime of contract employees for work (according to the Civil Law) should only be considered as part-time work for professionals with specialized skills, or those who choose to work as freelancers (freelancers).

Tiếng Việt

Tiếng Việt

Related posts: